The Best Guide To Anna Estephan

Wiki Article

Anna Estephan Things To Know Before You Get This

Table of ContentsThe 6-Second Trick For Anna Estephan6 Simple Techniques For Anna EstephanAn Unbiased View of Anna EstephanAnna Estephan Can Be Fun For EveryoneExcitement About Anna Estephan6 Easy Facts About Anna Estephan Shown

You have lots of options when it concerns purchasing property. You can purchase a single-family house, rent it out as well as accumulate month-to-month rent checks while waiting on its value to rise high adequate to create a huge earnings when you market. Or you can acquire a little shopping center and also accumulate monthly rents from hair salons, pizza restaurants, bed mattress stores and other organizations., short for real estate financial investment counts on, is one of the simplest ways to invest in actual estate. With a REIT, you invest in real estate without having to worry regarding maintaining or handling any kind of physical structures.

When you buy into a REIT, you buy a share of these homes. It's a bit like investing in a mutual fund, just as opposed to supplies, a REIT manage property. You can generate income from a REIT in two ways: First, REITs make routine dividend payments to capitalists.

You can spend in a REIT just as you would buy a stock: REITs are listed on the significant stock exchanges. The National Association of Realty Investment Trusts states that concerning 145 million united state locals are invested in REITs. Sinking your cash right into investment homes can also show financially rewarding, though it does need some work.

6 Simple Techniques For Anna Estephan

You can reduce the odds of a bad financial investment by researching neighborhood areas to locate those in which house worths have a tendency to increase. You need to also deal with realty agents as well as other experts that can you show historic appreciation numbers for the neighborhoods you are targeting. You will certainly need to bear in mind area.

You can purchase an office building as well as charge business to rent out space because building. You can acquire strip facilities or other retail homes and bill regular monthly rental fee to local business owner. You can even purchase a warehouse as well as charge lease to making companies or sellers who require to keep their items.

You could additionally struggle to find adequate tenants to fill up that office complex or retail center you purchased. Financiers who wish to earn money rapidly often look to home flipping. This is when you acquire a residence for a reduced cost, refurbish it quickly and after that market it for a rapid revenue.

Everything about Anna Estephan

You're not interested in month-to-month leas when flipping a house. Rather, you need to buy a house for the most affordable feasible rate if you desire to make an excellent revenue when selling - Anna Estephan.

February 9, 2022 Here are 7 factors to get a property: Everybody needs a place to live. The leading factor lots of original site people get a residential property is to live in it. If you have the financial means to own a residence, this is a great investment. Certainly, the worth of your investment depends upon the area and also kind of Click Here property, its condition and any renovations you perform.

The worth of your residential or commercial property can raise. Residential or commercial property worths generally climb throughout the years. If you effectively preserve your house or structure, you ought to have the ability to capitalize on this boost in worth. You profit from tax obligation reductions. If you restore a rental room or keep a rental residential or commercial property, you might be able to subtract these costs from your income.

Over time, your property grows in worth. You can after that utilize this built up worth to get a second home loan and invest in a 2nd building.

The Best Guide To Anna Estephan

Depending upon your profile as well as goals, you can discover the type of real estate investment that matches you. On top of that, you regulate the financial investments you make as well as choose the degree of commitment that matches you, whether it be a single triplex to several rental properties. Your residential property can function as a retirement fund.Naturally, you have to prepare to offer your building when you need the money. On the other hand, spending in a duplex or another sort of income home can offer you a normal resource of income for your retirement, without needing to sell and move. Realty is much safer than the majority of other forms of investment.

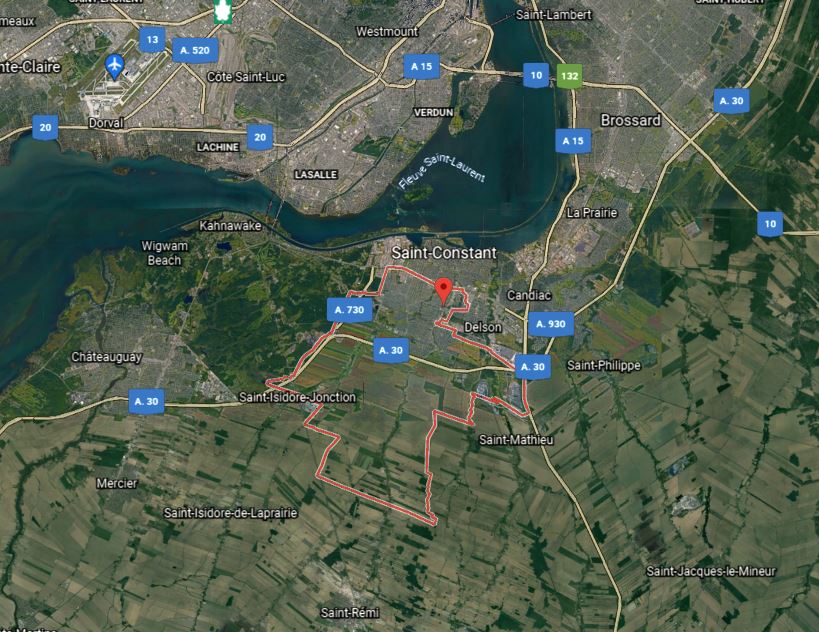

9%. Houses utilized as an investment were primarily possessed by individuals living in the exact same district as the home - Anna Estephan. Property can be owned for a number of factors: for use as a primary address, yet likewise for periodic use as a second home, to generate earnings or other financial investment functions.

5% in 2021. This article identifies between capitalists as well as other kinds of proprietors to better comprehend the account of investors, what they have, and the duty they play in the market.

Not known Factual Statements About Anna Estephan

The worth of your home can boost. Residential property values generally rise for many years. If you appropriately maintain your house or structure, you ought to have the ability to make the most of this rise in value. You benefit from tax deductions. If you refurbish a rental space click for more or preserve a rental residential property, you might have the ability to subtract these expenditures from your income.Over time, your building grows in worth. You can then leverage this accumulated worth to acquire a second home loan as well as invest in a 2nd property.

Relying on your profile as well as objectives, you can find the type of property financial investment that matches you. Additionally, you control the financial investments you make as well as choose the level of commitment that fits you, whether it be a single triplex to multiple rental buildings. Your residential or commercial property can function as a retired life fund.

Obviously, you need to be prepared to offer your property when you require the cash. On the various other hand, buying a duplex or one more sort of income residential property can give you a regular income for your retired life, without needing to offer and also relocate. Actual estate is much more secure than a lot of various other forms of financial investment.

The 10-Second Trick For Anna Estephan

9%. Homes used as an investment were primarily owned by individuals residing in the same province as the residential or commercial property. Property can be had for numerous factors: for usage as a primary location of house, but also for occasional use as an additional residence, to generate revenue or other investment objectives.

Report this wiki page